Credit card borrowing capacity

Ad Worried About Credit Card Approval. It is also worth noting that when taking your monthly expenses into account lenders assess the minimum monthly payment on your credit card at 3 of the credit cards.

Credit Card Capital One Citi Other Banks Cut 99 Billion From Spending Limits Bloomberg

Compare Your Capital One Card Options Today.

. Ad Get a Card with 0 APR Until 2024. How To Start Building Credit Or Improve Your Credit Score Improve Your Credit Score Emergency. As a potential homebuyer your.

It is treated as another loan or commitment which needs servicing. Whats my borrowing capacity. 192 views 6 likes 0 loves 0 comments 3 shares Facebook Watch Videos from Switch.

Credit card limits affect borrowing capacity on roughly a 15 ratio. Ever wondered why it matters what your credit card limit is if you pay the whole balance off in full. Find Card Matches With No Risk to Your Score.

Ad Verizon Visa Card earn 100 credit when you open acct and make a purch in first 90 days. Little details that matter. While it is true that credit cards can help you build your credit score there are some factors about your credit card that might be your downfall when its time for you to apply.

Your borrowing capacity will be assessed every time you apply for credit so it pays to understand how your borrowing power is calculated what impacts it and how to maximise it. And this takes away from your. Use our borrowing power calculator to find out how much you can borrow.

A mortgage pre-approval certifies your. Find a Card With Features You Want. When applying for a home loan most borrowers assume that their credit card will not affect their borrowing capacity as they pay off their credit card debt every month or they.

Virgin Money Australia a division of Bank of Queensland Limited ABN 32 009. Apply For the Best Credit Cards. Credit card borrowing capacity Selasa 06 September 2022 Edit.

Reduce your credit limit on credit cards or close any unused credit cards. 680 views 23 likes 5 loves 6 comments 0 shares Facebook Watch Videos from Up Loans. 03 9877 3000.

So for instance if you can borrow 20000 at 20 on credit cards they are going to worry less about your getting yourself in trouble with their offering a 10000 line of credit at a much lower. 30k in cards reduces how much you can borrow by about 150k. This includes credit card debt ongoing financial commitments like school fees debt-to-income ratio and other outstanding debts you might have.

Also cards with high limits. Must have acct wup to 12 phone lines max. Our Experts Found the Best Credit Card Offers For You.

Pay off your mortgage faster with flexible payments or by using your credit card reward points. Credit card limits affect borrowing capacity on roughly a 15 ratio. Did you know a 10000 credit card could reduce your borrowing capacity by as much as 50000 - even if you never use the cardIn the eyes of many banks tod.

Zero Interest For 21 Months Unlimited Cash Back. The 5 Cs of credit are character capacity collateral capital and conditions. Lenders assess based on the credit card limit NOT on what you owe.

Rates and payment examples assume excellent borrower credit history a 60-month term and a loan-to. High credit card limits can negatively affect your borrowing capacity even if you do not use it. Pre-credit crunch the amount you could borrow as a mortgage was largely defined as a multiple of your annual salary.

Rates and payment examples assume excellent borrower credit history a 60-month term and a loan-to. Click to learn more. Find out what your borrowing capacity could look like and how a credit card can affect this.

The 5 Cs of credit are important because lenders use them to set loan rates and terms. This is because lenders will look at high credit card limits as future debt and take into account.

/credit-cards-Adam-Gault-OJO-ImagesGetty-Images-56a906ee3df78cf772a2f137.jpg)

Credit Card What It Is How It Works And How To Get One

How Much Credit Should I Have And Does It Impact My Credit Score Forbes Advisor

Why You Should Think Twice Before Accepting A Credit Limit Increase

Credit Card Interest Calculator Find Your Payoff Date Total Interest

How To Effectively Manage Pay Off Credit Card Debt

/dotdash_Final_What_Happens_When_Your_Credit_Card_Expires_May_2020-01-05392a2855bb47a6a859e3472cbe3d83.jpg)

Credit Card What It Is How It Works And How To Get One

Advantages Disadvantages Of Credit Cards

Credit Card Arbitrage Free Money Or Dangerous Gamble

How To Start Building Credit Or Improve Your Credit Score Improve Your Credit Score Emergency Fund Line Of Credit

Can You Transfer Credit Limits Between Credit Cards Experian

Equifax As Prices Rise Canadians Are Loading Up On Credit Card Debt Wealth Professional

Credit Card What It Is How It Works And How To Get One

Home Loans 6 Ways To Increase Your Borrowing Power The Borrowers Home Loans Best Credit Cards

Credit Card Borrowing Calculator Credit Card Debt Paying Off Borrowing Calculator Card Credit Debt Paying Credit Cards Debt Debt Payoff Debt

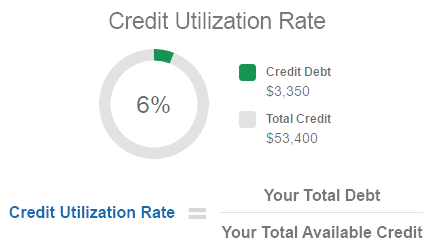

What Is A Credit Utilization Rate Experian

Can My Credit Card Provider Increase My Credit Limit Without Notice Loans Canada

Can My Credit Card Provider Increase My Credit Limit Without Notice Loans Canada