Interest only lifetime mortgage calculator

Use our comprehensive online mortgage calculator which shows the monthly interest only and repayment amounts on a mortgage. The homeowner can receive a lump sum or draw down equity over time.

Budget Pie Chart Money Personal Finance November 2019 Finance Saving Budgeting Emergency Fund

Close lower screen banner.

. If you paid the mortgage on a repayment basis youd owe the lender nothing and own the property outright at the end of the term. A retirement interest-only mortgage is a new way for older borrowers and people over 60 to get a mortgage on their home. For example at the time of writing Penrith Building Society offers an interest-only mortgage with a maximum term of 35 years and no maximum age limit for the end of the mortgage term.

If this happens its. Making decisions about how to finance your retirement is important so its worth shopping around and using available guidance and advice before you buy. These products are typically called lifetime mortgages.

The monthly interest rate payment calculator exactly as you see it above is 100 free for you to use. Presently the lowest fixed interest rate on a fixed reverse mortgage is 581 681 APR and variable rates are as low as 5205 with a 1875 marginDisclaimer. Call us free today for a no obligation chat on 0808 301 7044 0808 301 7044.

The 10000 limit is a lifetime limit. Lifetime mortgage interest rates. For example a 51 IO ARM would charge interest-only for the first 5 years of the loan then at that point the loan would convert into an amortizing loan where.

401kIt is possible to take out a loan for either up to 50000 or half the value of the 401k account whichever is less. Lifetime mortgages Interest Only Drawdown Lump Sum plans more. This loan will require repayment with interest but there will be no tax or penalties on the loan amount.

In simple interest you earn interest on the same principal for the investment term and you lose out on income that you can earn on that additional amount. An interest-only mortgage can make a mortgage more affordable but in this case it would mean that in 25 years time youd still owe the lender 200000. About our Lifetime Mortgages About our Lifetime Mortgages Lifetime mortgage calculator Lifetime mortgage calculator.

If you want to customize the colors size and more to better fit your site. Mortgage calculator Mortgage. The UK Mortgage Calculator is mainly intended for United Kingdom residents using the British Pound currency.

How flexible is a Retirement Interest Only Mortgage. Comprehensive mortgage calculator as well as the basic mortgage calc you can check the impact of savings vs mortgages offset mortgages overpayments and more. Such as a lifetime mortgage may be a suitable.

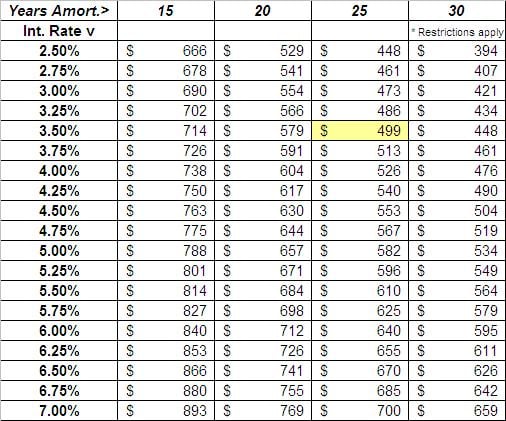

This calculator shows how much you pay each month each year throughout the duration of the loan for each 1000 of mortgage financing. The mortgage amortization schedule shows how much in principal and interest is paid over time. About our Retirement Interest Only Mortgage About our Retirement Interest Only Mortgage Retirement Interest Only Mortgage calculator Retirement Interest Only Mortgage calculator.

Just enter your current interest rate mortgage term and outstanding loan and well do the rest. Trying to find an interest only mortgage. Find out the eligibility deposit requirements lenders best rates in our expert guide.

Find out how they work which providers offer retirement mortgages and how a retirement mortgage compares to equity release. By showing what youll pay each month as well as the total cost over the lifetime of the mortgage depending on the deal you just need to input some basic info such as. Call us free on.

Enter the contractually agreed residual value at the end of the lease. Use our mortgage interest calculator to find out how much extra youd pay if your mortgage rate increased by between 025 and 3. The most common mortgage term in Canada is five years while the most common amortization period.

You can compare the monthly cost of your mortgage on a repayment agreement versus an interest-only deal by using our calculator below. There is a difference between amortization and mortgage termThe term is the length of time that your mortgage agreement and current mortgage interest rate is valid for. Other Costs yr.

Borrowers with a lifetime tracker mortgage can expect to see early. It can still be done. The mortgage amortization period is how long it will take you to pay off your mortgage.

For example you might want to calculate mortgage interest for a mortgage of 500000 with monthly payments of 2500 at a 3 mortgage rate. Provides graphed results along with monthly and yearly amortisation tables showing the capital and interest amounts paid each year. Its recommended that you test out scenarios on our home mortgage calculator to see how interest rate changes as you shift back and forth between different loan terms.

See how those payments break down over your loan term with our amortization calculator. A cap of 225 means the loan can change up to 2 on any adjustment up to a lifetime adjustment of 5 above the initial rate of interest. Find out how much money you could potentially release with an interest-only lifetime mortgage.

Find out what you could potentially save by switching to a new plan. 7YR Adjustable Rate Mortgage Calculator. Already have a lifetime mortgage.

If you have 100 and the simple interest rate is 10 for two years you will have 102100 20 as interest. N the number of payments over the lifetime of the loan. This calculator adds in discount points loan origination fees and closing costs along with any recurring PMI fees into the loans original APR to figure out the effective cost of your loan with all these.

Interest rates are subject to change without notice. Interest and principal will be paid back to the 401k owner. N 30 years x 12 months per year or 360 payments.

If you have a mortgage with them you may find they will consider extending your term to the maximum length. To calculate interest paid on a mortgage you will first need to know your mortgage balance the amount of your monthly mortgage payment and your mortgage interest rate. If you take out a 30-year fixed rate mortgage this means.

This field should be populated only if you are calculating a lease payment.

Time Line Timeline Infographic Infographic Timeline Design

How One Couple Is Planning On Paying Off 23 000 Of Debt In Only 12 Months Or Less Paying Off Credit Cards Credit Card Payoff Plan Debt

:max_bytes(150000):strip_icc()/MortgateRates.Fed.StL-0099d59e398e4f239bc0cc4154e04cb7.jpg)

Mortgage Calculator

Blueprint Retirement Income Can I Retire Yet Retirement Income Blueprints Income

Credit Restrictions Cost Home Buyers Deal Of A Lifetime Buying First Home First Home Buyer Mortgage Loans

Douglas Riddle Afv Accepted For Value Knowledge And Wisdom How To Fix Credit Common Law

How To See Your Bonds From Your Birth Certificate Fidelity Com Part 3 Youtube Birth Certificate Personal Sovereignty Birth Records

Finance Perfect How Do Life Insurance Policies Work Life Insurance Policy Permanent Life Insurance Insurance Policy

Mortgage Pre Approval Checklist Realtor Flyer Mortgage Etsy Preapproved Mortgage Realtor Flyers Flyer

/MortgateRates.Fed.StL-0099d59e398e4f239bc0cc4154e04cb7.jpg)

Mortgage Calculator

Mortgage Affordability Calculator 2022

Pin On Dustin Brohm Equity Real Estate Agent

Pin By Bichri Ephaja On Random How To Find Out Online Calculator Cash From Home

Ez Mortgage Payment Table

Pin On App

Finance Perfect How Do Life Insurance Policies Work Life Insurance Policy Permanent Life Insurance Insurance Policy

Ssjtafrpq7xz M